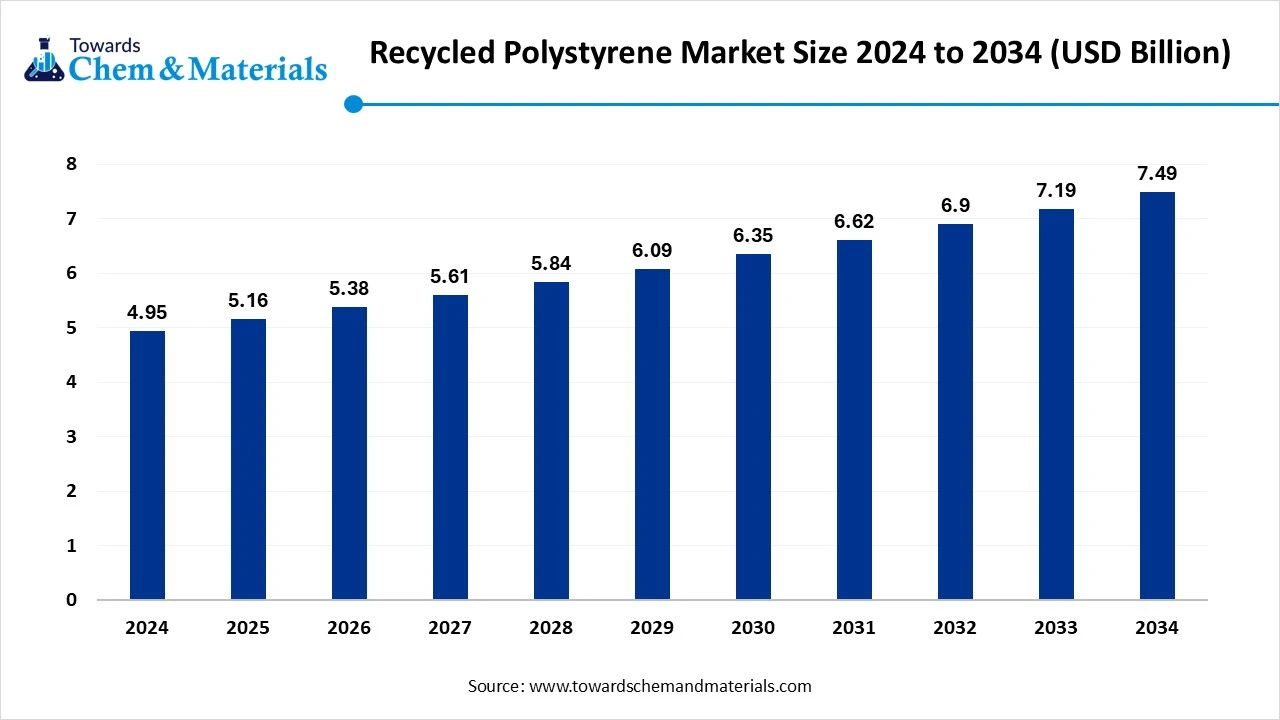

Recycled Polystyrene Market Size to Worth USD 7.49 Billion by 2034

According to Towards Chemical and Materials, the global recycled polystyrene market size was estimated at USD 4.95 billion in 2024 and is expected to be worth around USD 7.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.23% over the forecast period from 2025 to 2034.

Ottawa, Aug. 26, 2025 (GLOBE NEWSWIRE) -- The global recycled polystyrene market size is valued at USD 5.16 billion in 2025 and is anticipated to reach around USD 7.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.23% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The market is growing because of widespread environmental concern, regulatory obligations around supporting plastic recycling, cost advantages over virgin product, and advancements in technology around recycling processes. All of these indicate a path for continued growth.

Download a Sample Report Here @ https://www.towardschemandmaterials.com/download-sample/5769

Recycled Polystyrene Market Overview

The recycled polystyrene market refers to the business of recycling usable polystyrene waste into reusable forms of material for packaging, construction and consumer products across the globe. The growing demand for recycled polystyrene is driven by increased environmental awareness, regulations on plastics waste, and a growing preference for sustainable materials. Recycled polystyrene can deliver high performance reusable materials in an economical way while decreasing landfill elements. The increasing applications of recycled polystyrene, particularly in construction, electronics, and packaging; as well as advances in recycling technology, also contribute to growth. Overall, the market presents a directional approach to a circular economy, focusing on sustainability and efficiency of resources in the industrial and consumption sectors.

Recycled Polystyrene Market Highlights

- By region, Asia Pacific dominated the recycled polystyrene market in 2024 with 45% of the market share, akin to the presence of the enlarged recycled plastic manufacturing bases in the region.

- By product type, the expanded polystyrene segment led the market in 2024 with 50% market share, due to its continuous consideration as a crucial element in industries such as packaging, food services, and insulation in the current period.

- By the recycling process, the mechanical recycling segment emerged as the top-performing segment in the market in 2024 with 65% industry share, due to its characteristics and benefits, like a simple procedure, cost-effectiveness, and wide availability.

- By form type, the recycled pellets segment led the market in 2024 with 55% market share because they are easy to store, transport, and process into new products.

- By end-use industry, the packaging and food services segment led the market in 2024 with 50% market share, because polystyrene is lightweight, insulating, and cost-effective, making it ideal for protecting food and goods.

- By source type, the post-consumer waste segment led the market in 2024 with 60% market share, because most polystyrene products, such as food containers, packaging materials, and single-use items, come from consumer use.

- By distribution channel, the direct sales to manufacturers segment emerged as the top-performing segment in the recycled polystyrene market in 2024 with 55% industry share, because it provides a steady and reliable supply chain for recycled polystyrene.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5769

Recycled Polystyrene Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 5.16 billion |

| Revenue forecast in 2034 | USD 7.49 billion |

| Growth rate | CAGR of 4.23% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2019 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in Kilotons, Revenue in USD million and CAGR from 2025 to 2034 |

| Report coverage | Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type, By Recycling Process, By Form, By End-Use Industry, By Source, By Distribution Channel, By Region |

| Key companies profiled | FP Corporation, MBA Polymers, Intco, IBI, Gree, Chongqing Gengye New Material Technology, Zhaoqing Hongzhan Hardware Plastic, Changhong, Jiangxi Green Recycling, Rhino, Dongguan Guo Heng Plastic Technology |

What are the Major Trends in the Recycled Polystyrene Market?

- New Recycling Technologies- The advent of chemical recycling and depolymerizing techniques is improving recycled polystyrene quality, providing potential for use in high-end applications while overcoming degradation and contamination challenges.

- Increased Demand for Packaging- Sustainable packaging is increasing the demand for recycled polystyrene (especially food containers and protective packaging) as companies respond to consumer demands and regulations by moving towards sustainable material sourcing.

- Engagement of the Construction Sector- Recycled polystyrene use is increasing in insulation boards, lightweight concrete and green building materials - driven by urbanization, increased demand for sustainable practices, and energy-efficient benefits.

- Integration with the circular economy- Governments and industries are increasingly focusing on closed-loop systems that leverage recovery, collection, sorting and reuse of polystyrene waste, aligning with circular economy principles and reducing environmental impact across various industries.

Growth Factor in the Recycled Polystyrene Market

Could Global EPS Recycling Scale Drives the Sustainable Polystyrene?

The rapid expansion of globally developed expanded polystyrene (EPS) recycling systems is a significant contributor to the development of the recycled polystyrene market. The transition from disparate national programs to a worldwide effort to create a recycling infrastructure was possible with the support of The Global EPS Sustainability Alliance. As of 2023, 72 countries have established EPS recycling infrastructure, and notable recycling rates in Asia are reported for China (46%), Japan (68%), Korea (88%) and Taiwan (83%).

The United Nations Environment Programme has even included EPS in transport packaging as one of only six plastics categorized as accounting for recycling at scale globally.

This trend of developing global infrastructure and recognition not only reinforces the opportunity for EPS recycling but also drives investment and adoption of sustainable polystyrene solutions across packaging, construction and consumer goods.

Market Opportunity

Could Breakthrough Food-Grade Recycling Fuel A Circular Boom For Recycled Polystyrene?

The recycled polystyrene market has a unique opportunity to obtain food-contact-grade purity via mechanical recycling and make huge strides towards truly circular packaging. For example, an innovative development by INEOS Styrolution in December 2024 produced a yoghurt cup entirely from mechanically recycled polystyrene that met EU food safety restrictions - a level of purity previously achieved only by PET recycles.

In January 2025, the Plastics Industry Association introduced the Polystyrene Recycling Alliance (PSRA) to increase access to recycling and achieve "widely recyclable status" status by 2030. Currently, 32% of Americans recycle polystyrene, and the initiative will support increased recycling rates through infrastructure development, collaboration, and education.

Altogether, these advances confirm recycled PS is legitimate for high-value, safe applications and offer promising scalable recycling systems - increasing demand and allowing for recycled polystyrene, or polystyrene made from recyclate to earn its place at the table across packaging, foodservice, and further.

Limitations and Challenges in the Recycled Polystyrene Market

- Quality and Performance Concerns- Recycled polystyrene generally has reduced purity and mechanical strength compared to virgin material, resulting in quality variability. These quality constraints limit its application to high-performance sectors most notably food grade packaging and medical applications where industry standards are strict due to safety concerns.

- Resources and Time Constraints- Effective recycling of polystyrene requires sophisticated collection and sorting and processing centers which are nonexistent in many locations. As a result, there are considerable barriers to large scale recovery and consequently limited supply and conversion across industries.

- Processing Expenses- Polystyrene recycling is complex with respect to cleaning, sorting and reprocessing. Furthermore, the intensive energy consumption raises costs and reduces competition from recycled material to virgin materials in highly price sensitive industries.

- Regulatory and Market factors- This includes regulatory issues associated with food-safety regulations affecting food packaging and limited incentives from regulatory agencies and governments, not to mention the uncertainty of recycled plastics as compared to virgin material. In particular, inconsistent recycling policies in many different regions contribute towards lowered incentive levels affecting overall investment and growth in the marketplace.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Why is Asia Pacific the dominant player in the recycled polystyrene market?

Asia Pacific dominated the recycled polystyrene market in 2024 is driven by the concentration of downstream demand (packaging, construction, electronics) and high volume manufacturing hubs that produce steady, predictable waste streams of PS ready for collection and mechanical recycling. Rapid urbanization and growth in cold-chain/packaging has ensured steady feedstock. Meanwhile, private recycling investment and industrial take-back programs have been established in numerous APAC countries, which has improved regional capacity.

China Market Trends

China occupies the leadership role in the region due to the scale of its packaging and construction sectors, which generate significant volumes of PS global waste streams that are capitalized on by both informal and formal recyclers. Recent studies have shown rate of with 46% China amongst Asian countries demonstrating significant performance relating to EPS recycling largely informed by efforts made by networked municipal collection, private reclaimers, and investment in densification/compaction equipment that allows municipal operations to reduce the cost of transportation, thereby ensuring an economic justification for recycled polystyrene.

Why Europe showing up as the Fastest Growing Region in Recycled Polystyrene?

Europe expects the fastest growth in the market during the forecast period. Europe’s rapid growth is policy-driven extended producer responsibility (EPR), ambitious circular-economy targets, and tougher municipal collection and acceptance criteria are all improving PS's collection quality and quantities collected. Coordination of the industry through trade bodies has elevated efficiency in recycling EPS packaging and committing to target increases for 2025-2030, which connects customers to expected demand for recycled PS. In concert with funding to promote innovation by supporting chemical upcycling or by doing feedstock sorting, regulatory pressures and incentives are transforming some very low-value streams of EPS into commercially viable recycled materials thus, Europe is growing faster than mature consumption markets.

Market Trends in Germany

Germany is leading Europe's charge with a much more comprehensive waste-sorting infrastructure in place, very ambitious recycling mandates, and large end-markets in automotive, and construction that can further absorb recycled polystyrene. Further, the industry's progress reports indicate evidence of rising national recycling rates with targeted pledges that national governments are subscribing too. Germany is activating national pledges through municipal programs and coordinated partnerships are improving the quality of feedstock and commercials for recycling PS.

Recycled Polystyrene Market Segmentation

Product Type Insights

What Product Type is the Most Dominant in Recycled Polystyrene Market?

The expanded polystyrene (EPS) segment dominated the market in 2024, because of its high utilizations as insulation, packaging, and protective materials. EPS is a lightweight, durable, and excellent insulator with multiple uses for food packaging, construction panels, and cushioning. EPS's leading role in the market has been furthered by its increased demand for sustainable and recyclable materials by packaging industries.

The high-impact polystyrene (HIPS) segment is predicted to experience the fastest growth during the forecast period. The growth in HIPS is attributed to higher adoption as enhanced impact resistance and versatility compared to other grades, especially in electronics, appliances, and automotive applications. Additionally, accumulating pressure on manufacturers to explore the use of recycled materials in the production of consumer goods has driven a rise in the use of recycled HIPS, especially as it is the most significant growth area product type.

Recycling Process Insights

Which is the Dominant Recycling Process in Recycled Polystyrene Market?

The mechanical recycling segment led the market in 2024, as it is cost-effective and has been around for a long time with the infrastructure to support it. Mechanical recycling is shredding and recycling polystyrene into pellets, which can then be used in packaging, in the building construction and consumer products. The operational simplicity, scalability, and energy efficiency of mechanical recycling will keep this process as the preferred method for managing both post-consumer and post-industrial waste, giving mechanical recycling the market share it has.

The chemical recycling segment is estimated to have the highest growth rate, over the evaluated period. Chemical recycling allows polystyrene to be broken down into its respective monomers and ultimately could yield higher quality material with properties that are similar to virgin polystyrene. The demand for closed-loop recycling solutions has increased, resulting in higher investments in advanced recycling, coupled with regulatory support to establish circular economy initiatives are creating the quick uptake in chemical recycling, as it will drive future growth in this market.

Form Insights

Which Form Dominates the Recycled Polystyrene Market in 2024?

Recycled pellets segment dominated the market in 2024, because of its versatility and readily adopted industrial application. Pellets can easily be reprocessed as new packaging materials for many industries, as well as insulation products and consumer goods, providing manufacturers with a readily available and lower-cost feedstock. The fact that recycled pellets can be processed with extant plastic processing equipment has led to a growing demand across various sectors including packaging and construction alike, affirming its position as the leading form type in the market.

The styrene monomer segment is projected to grow the fastest during the forecast period. This form is manufactured primarily through advanced chemical recycling that converts polystyrene back to monomer so that it can be used again, effectively producing high quality products that are on-par with virgin material. The push toward closed-loop recycling and circular models of the economy is driving demand for styrene monomers, especially in industries (i.e. electronics and specialty packaging) that impose strict performance and quality standards.

End Use Industry Insights

Why Packaging and Food Segment Dominates the Recycled Polystyrene Market in 2024?

The packaging and food services segment is the largest market in 2024, driven by increasing demand for lightweight and sustainable packaging. Recycled polystyrene is also used in containers, trays, disposable utensils, and other protective packaging because it is durable and affordable. In addition, the increased focus on eco-friendly packaging in quick-service restaurants, food delivery services, and other consumer products has strengthened this segment of the market.

The electrical and electronics segment is expected to grow the fastest over the upcoming years. The increase in impact resistance, lightweight and recyclable materials in casings, components, and insulation has maximized the use of recycled polystyrene in this sector. To reduce e-waste and increase sustainable electronics manufacturing, a market-wide push will enhance adoption in this end-use industry.

Source Type Insights

Which Source Type Dominates the Recycled Polystyrene Market in 2024?

The post-consumer waste segment dominated the market in 2024, with strong increases in the collection of used packaging, disposable food containers, and consumer products driving this growth. Governments and recycling organizations have invested heavily in waste segregation and collection, setting up systems in place to provide a consistent source of post-consumer polystyrene. This category is supported further by the rise in demand for sustainable packaging, and increasing regulations around the disposal of plastic waste.

The post-industrial waste segment is expected to grow the fastest during this period. This segment typically has a consistent quality and quantity since post-industrial polystyrene (that can be recycled) is waste that was never sold to a consumer aka manufacturing scrap, offcuts, and defective production batches. Since more industries are finding opportunities to divert waste from landfills, and to increase their sustainability narrative, the amount of post-industrial waste being recycled for polystyrene will certainly increase over this period as a reliable feedstock for quality recycled polystyrene.

Distribution Channel Insights

Why Direct Sales Segment Dominates the Recycled Polystyrene Market in 2024?

The direct sales to manufacturers segment dominated the market in 2024, with strong supply relationships maintaining the flow of recycled product from recyclers to end-use industries. Manufacturers prefer to procure directly from recyclers to ensure continuous access to recycled polystyrene, consistent product quality, and cost efficiencies as they make large scale applications in packaging, construction or electronics. Contracting through direct sales also enables recyclers to establish long-term agreements, so it is seen as the most certain and dominant channel for distribution.

The online polymer trading platform segment is expected to register the highest growth rate in forecasted period. Digital trading systems continue to flourish by providing buyers and sellers with greater access, transparent pricing, and faster transactions. Increased move toward digital procurement in material made from recycled plastics, coupled with the strong movement towards traceable and certified recycled plastics is precipitating quicker adoption and growth of online platforms as a channel to market, establishing online platforms as the major emerging channels in the recycled polystyrene industry.

More Insights in Towards Chemical and Materials:

- Recycled Plastics In Green Building Materials Market : The global recycled plastics in green building materials market size was reached at USD 5.31 billion in 2024 and is expected to be worth around USD 12.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.71% over the forecast period 2025 to 2034.

- Recycled Thermoplastics Market : The global recycled thermoplastics market size was estimated at USD 57.85 billion in 2024 and is expected to hit around USD 145.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.65% over the forecast period from 2025 to 2034.

- Recycled Polyester Market : The global recycled polyester market size is calculated at USD 15.85 billion in 2024, grew to USD 17.32 billion in 2025 and is predicted to hit around USD 38.53 billion by 2034, expanding at healthy CAGR of 9.29% between 2025 and 2034.

- Recycled Polyolefin Market : The global recycled polyolefin market size accounted for USD 61.19 billion in 2024, grew to USD 66.67 billion in 2025, and is expected to be worth around USD 144.2 billion by 2034, poised to grow at a CAGR of 8.95% between 2025 and 2034.

- U.S. Extruded Polystyrene Market : The U.S. extruded polystyrene market size was reached at USD 1.85 billion in 2024 and is expected to be worth around USD 3.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.75% over the forecast period 2025 to 2034.

- Expandable Polystyrene Market : The global expandable polystyrene market volume was reached at 7.21 million tons in 2024 and is expected to be worth around 9.33 million tons by 2034, growing at a compound annual growth rate (CAGR) of 2.61% over the forecast period 2025 to 2034.

- Polystyrene Market : The global polystyrene market volume was reached at 40.09 million tons in 2024 and is estimated to surpass around 62.33 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.51% during the forecast period 2025 to 2034.

- Recycled Plastics Market : The global recycled plastics market size was reached at USD 83.19 billion in 2024 and is expected to be worth around USD 183.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034.

- Recycled PET (rPET) Market : The global recycled PET (rPET) market size was reached at USD 12.85 billion in 2024 and is expected to be worth around USD 29.19 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.55% over the forecast period 2025 to 2034.

- Recycled Polystyrene Market : The global recycled polystyrene market size was reached at USD 4.95 billion in 2024 and is expected to be worth around USD 7.49 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.23% over the forecast period 2025 to 2034.

Recycled Polystyrene Market Top Key Companies:

- FP Corporation

- MBA Polymers

- Intco

- IBI

- Gree

- Chongqing Gengye New Material Technology

- Zhaoqing Hongzhan Hardware Plastic

- Changhong

- Jiangxi Green Recycling

- Rhino

- Dongguan Guo Heng Plastic Technology

Recent Developments

- In January 2025, Ineos Styrolution reported that it is now using mechanically recycled polystyrene, made using a super-clean cleaning purification process, meeting the European Food Safety Authority (EFSA) requirements for food contact materials. According to Dr. Frank Eisenträger, market development manager at Ineos Styrolution, "This technology will enable producers to meet the requirements of the new EU directive on packaging and packaging waste (PPWR).”

- In February 2025, Trinseo launched dissolution-recycled transparent polystyreneresin featuring dissolution technology. These resins contain 30% recycled materials and are available immediately for sale. This development results in a product carbon footprint reduction of approximately 18% compared to the virgin product.

Recycled Polystyrene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Recycled Polystyrene Market

By Product Type

- Expanded Polystyrene (EPS)

- High Impact Polystyrene (HIPS)

- General Purpose Polystyrene (GPPS)

By Recycling Process

- Mechanical Recycling

- Chemical Recycling (Depolymerization, Pyrolysis, Solvent-Based Recovery)

By Form

- Recycled Pellets

- Regrind/Flakes

- Styrene Monomer (from chemical recycling)

By End-Use Industry

- Packaging & Foodservice

- Construction

- Electrical & Electronics

- Automotive

- Consumer Goods

By Source

- Post-Consumer Waste

- Post-Industrial Waste

By Distribution Channel

- Direct Sales to Manufacturers

- Plastic Recyclers & Resin Distributors

- Online Polymer Trading Platforms

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5769

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.